The Evolving Payments Landscape

The global payments landscape has undergone rapid technological advancements, transforming how consumers and businesses manage transactions. The rise of digital wallets like Apple Pay, Google Pay, Samsung Pay, and local solutions like GCash and Maya has made contactless payments more accessible than ever. Similarly, technologies like NFC (near-field communication) and QR code payments provide faster and more secure transaction methods, while blockchain solutions like Visa B2B and Mastercard Send revolutionize cross-border payments. For example, the adoption of digital wallets has surged globally, with countries like China and Japan leading the way in contactless payment adoption.

With increasing payment volumes and complexity come greater security risks and regulatory oversight. Payment companies must navigate regulations such as PCI DSS (Payment Card Industry Data Security Standard), PSD2 (Payment Services Directive), and GDPR (General Data Protection Regulation) to ensure the protection of consumer data while enabling real-time payments.

Automated testing has become a crucial tool in this rapidly evolving industry. It ensures compliance with industry regulations while maintaining system reliability and security. Fintech leaders and payment companies cannot afford the slow pace of manual testing cycles when they need to continuously innovate products and solutions and stay competitive.

The Need for Automated Testing in Payments

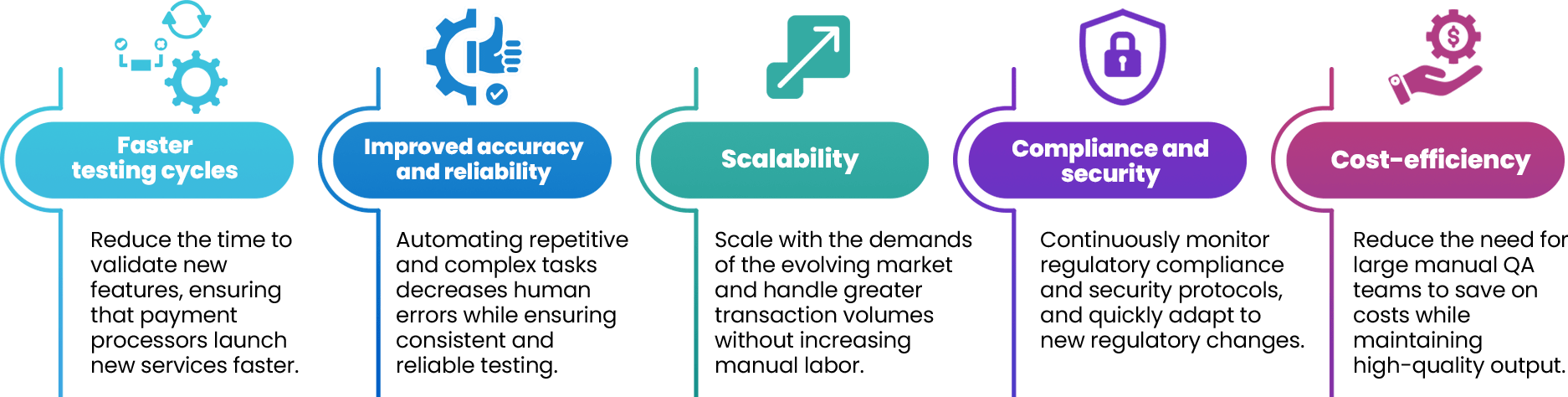

The payments industry handles millions of transactions per day. For payment processors like Visa, Mastercard, and emerging BNPL (Buy Now, Pay Later) providers, testing their products and transactions manually is both resource-intensive and time-consuming. Automated testing enables these companies to conduct repetitive tests for performance, security, and accuracy, ensuring they can roll out new features quickly and securely.

Companies must perform continuous testing to avoid costly breaches or downtime. Automated testing ensures systems are protected against cybersecurity threats while remaining compliant with ever-changing regulations. While manual testing may struggle to keep up with the complexity of modern payment systems, especially when handling real-time payments, automation mitigates this by reducing human errors and enabling faster, more reliable releases.

Benefits of Modern Testing Solutions

Impact of Automated Testing on the Payments Industry

a. Automated testing facilitates the continuous release of new, innovative features: Companies like PayPal and Revolut are at the forefront of integrating automated testing into their CI/CD pipelines, which allows them to release new features with minimal downtime.

b. Shorter development cycles enable experimentation: Automated testing shortens the development cycle by allowing fintech teams to rapidly test and release updates. This enables them to experiment with new payment solutions and integrate emerging technologies like AI and blockchain more quickly and confidently, staying ahead of the competition and meeting evolving customer needs.

c. Supporting faster adaptation to customer needs: By using automated testing, companies can quickly iterate based on customer feedback and market trends, staying agile in a fast-changing environment.

Addressing Future Challenges with Automated Testing

As the payments industry undergoes rapid digital transformation, automated testing will help companies scale their operations without sacrificing quality. With the growing complexity of payment systems and the introduction of emerging technologies, payment processors and fintech companies must remain flexible and adaptable. Automated testing provides the agility to integrate these new technologies seamlessly, ensuring continuous improvement and innovation.

Automation also allows companies to prepare for a future driven by AI and machine learning. These technologies will enhance automated testing by enabling smarter, self-improving test cases that adapt to changing system behaviors and usage patterns. As the complexity of payment systems increases, AI-driven test automation will help reduce the burden on QA teams and enhance the speed and accuracy of software releases.

Companies must also prioritize investment in modern testing solutions and workforce development. Building a skilled team capable of leveraging the latest automation technologies will help harness the full potential of automated testing. Investing in tools that enhance scalability and compliance, combined with continuous upskilling of the workforce, will help organizations address future challenges effectively while driving long-term innovation and growth.

Transform Your Payment Systems with Automated Testing

Automated testing is a game-changer for the payments industry. It enhances scalability, ensures compliance, and drives continuous innovation, all while reducing costs. As fintech companies, financial institutions, and payment processors face new challenges in a rapidly evolving landscape, automated testing will be key to staying competitive and speeding up time-to-market while ensuring quality.

Consult with #StratpointQA experts to explore how our automated testing solutions can help your organization scale quickly, and stay ahead in the innovation race.